Additional Data Required For All Recreational Sales

The Oregon Health Authority, on behalf of the Oregon Department of Revenue, notified registered medical marijuana dispensaries Tuesday of new requirements for recreational cannabis sales receipts that will be mandatory next month.

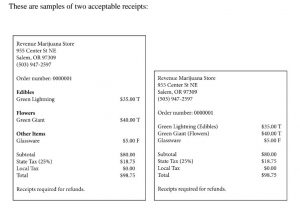

Beginning June 2, receipts for recreational marijuana sales must include:

- Your business name and address.

- An identification of which products were taxed.

- The category of tax product for each product sold, either as a heading for a group of products or as information associated with the product name.

- The total amount of the sale before tax.

- The total state tax amount.

- The total local tax amount, if applicable.

- The total cost to the customer.

- The transaction number that is applied to each receipt and unique for each transaction.

- An informational statement indicating that the customer must retain the receipt if they wish to dispute the tax.

These new requirements are being implemented by the Oregon Department of Revenue so that the agency can better administer the tax on all recreational marijuana sales.

If you’re using any of the popular POS or Seed to Sale software products, it’s likely some minimal tweaking will allow you to adhere to the new receipt requirements. Really though, whatever works for your business will satisfy your regulatory burden, as long as it provides the required information to the consumer.

If you’re interested in perfectly matching the Oregon Department of Revenue data fields for categorizing taxable recreational marijuana products under our current early start provisions, use the following fields:

- The seeds of marijuana (Seeds).

- The dried flowers of marijuana (Flowers).

- The dried leaves of marijuana (Leaves).

- A marijuana plant that is not flowering (Plants).

- Cannabinoid edibles (Edibles).

- Non-psychoactive medical cannabinoid products intended to be applied to a person’s skin or hair (Topicals).

- Prefilled receptacles of cannabinoid extracts (Extracts).

Some HB 3460 stakeholders may find it difficult to meet the new regulatory requirement by the June 2 deadline. If push comes to shove, acceptable records do include paper receipts with all of the required information.

If you have questions you can contact the Oregon Department of Revenue “Marijuana Tax Program Team” at 503-947-2597 or email them at marijuanatax.dor@oregon.gov.

Oregon Department of Revenue

Marijuana Tax Program

PO Box 14630

Salem OR 97309-5050